restaurant food tax in maine

See also additional excise tax below Maine manufacturer When selling low-alcohol spirits. The best restaurants in Maine have attracted top chefs who have access to some of the freshest ingredients.

Pemaquid Pulled Pork Broad Arrow Farm Market Butcher

Web Low-alcohol spirits products excise tax 124gallon spirits products to Maine retailers.

. Web Maines general sales tax of 55 also applies to the purchase of wine. Web Retail sales tax is the state of Maines principal tax source. Businesses making retail sales in Maine collect sales tax from their customers on tangible personal.

Web Retailers who want to request a payment plan may also contact the MRS Compliance Division at 207 624-9595 or compliancetaxmainegov. Long Term Auto Rental. Web A Maine Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

Web store all sales that are made from the restaurant facility are subject to tax at the prepared food rate even if the overall facility does not meet the 75 rule. This page describes the taxability. COVID-19 Update Webinar Registration.

The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55. Exact tax amount may vary for different items. Depending on the type of business where youre doing business and.

303 Packaging and Labeling. Maine Department of Economic Community Development. 331 State of Maine Food Code 2013.

302 Method of Sale of Commodities. Web This bulletin is not intended for retail locations that primarily sell prepared food. Sales Tax and Service Provider.

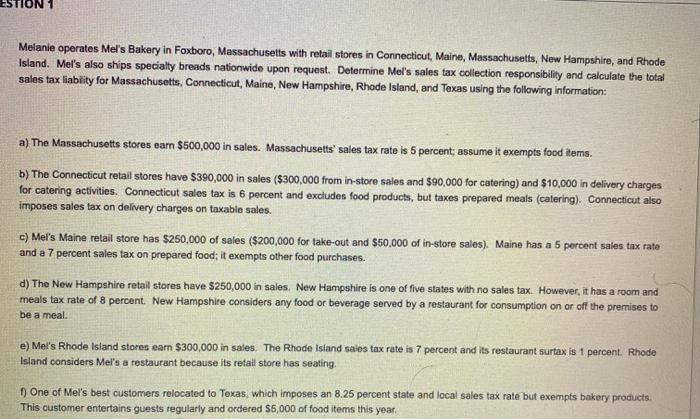

Maine is home to northern New. Web Maine Prepared foods are taxable in Maine at the prepared food tax rate of 8. The Maine Sales and Use Tax Law provides that sales of prepared food are taxable at a separate rate.

Short Term Auto Rental. In Maine wine vendors are responsible for paying a state excise tax of 060 per gallon plus Federal. Web Maine Dining.

Web 2022 Maine state sales tax. You can read Maines guide to sales tax on prepared food here. Maryland Food for.

Web While Maines sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Web Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you.

Luncheon Specials Green Leaves Chinese Restaurant Japanese Restaurant And Lounge Of York Maine

Where To Eat And What To Order In Portland Maine The Boston Globe

Eagles Nest Resturant Brewer Restaurant Reviews Photos Phone Number Tripadvisor

Cousins Maine Lobster Did You Know We Have A Storefront Location At The Budd Dairy Food Hall In Italian Village Same Great Lobster Expanded Menu Rooftop Bar Music Trivia Etc

Great White Shark Bites Seal In Half Off Maine Coast Do Not Touch The Seal

One Of The Next Great Food Cities In America Is In Maine According To Food Wine

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

The New Portland Maine Chef S Table Extraordinary Recipes From The Coast Of Maine Hathaway Margaret Schatz Karl 9781608939596 Amazon Com Books

Exemptions From The Maine Sales Tax

New York Sales Tax Basics For Restaurants Bars

Maine 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Musette Restaurant And Mobile Caterer Menu In Kennebunkport Maine Usa

The Waters Edge At Giovanni S Thewatersedgect Twitter

How To Get Restaurant Licenses And Permits And What They Cost

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Maine Sees Economic Growth In Second Year Of Pandemic But A Lot Of Money On The Sidelines Centralmaine Com

Maine Diner Wells Menu Prices Restaurant Reviews Tripadvisor

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation